Massively Higher Conversion Rate

Obility recently compared client campaign performance versus the industry benchmark for B2B companies. In no surprise, Obility clients’ campaigns significantly outperform standard B2B paid search campaigns. But, not all campaigns are the same. Obility intentionally separates and categorizes campaigns as part of its TACO strategy. In this post, we dig into how competitor campaigns– campaigns specifically targeting competitor brands – perform against other campaigns.

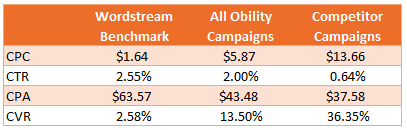

First, let’s look at the data from the original benchmark study and compare how paid search competitor campaigns perform against Wordstream’s benchmark and Obility campaigns as a whole.

In comparing performance, a couple aspects stand out. One, the cost per click (CPC) of competitor campaigns is expensive, more than double a typical Obility client campaign and more than 8x the benchmark CPC. Clearly competitor campaigns attribute to the higher CPCs of Obility client campaigns. Two, the conversion rate is absurdly high for paid search campaigns. Part of the high conversion rate is how AdWords counts “conversions” versus “converted clicks” (an area addressed below), but in an apples-to-apples comparison, competitor campaigns are clearly top performers.

Offer Performance in Competitor Campaigns

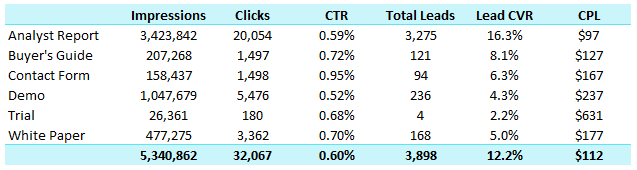

As mentioned above, we used cost per action, conversions, and conversion rate (CVR) to mirror the data used in the Wordstream benchmark study. Better data points to evaluate conversion rate performance includes converted clicks that become leads, lead conversion rate, and cost per lead. When comparing types of offers used in competitor campaigns, we used these data points (notice the drop in CVR).

Whether we measure conversions or leads, analyst reports are effective offers used in competitor campaigns. They have a much higher lead conversion rate and lower cost per lead (CPL) than other offers. Using analyst reports in competitor campaigns also appear to qualify users. They have a lower clickthrough rate (CTR) than other offers indicating folks uninterested in the report are not clicking. Comparatively, where a contact form is used and Obility clients likely do not call out the specific call to action, the CTR is higher, but leads only convert ¼ as often as analyst reports.

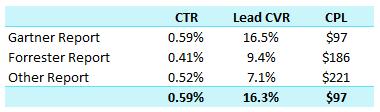

Looking at specific analyst report performance for Obility clients is not all that valuable:

The vast majority of Obility client competitor campaigns using analyst reports use Gartner reports, typically Magic Quadrant reports. Part of the reason is lack of availability or freshness of other analyst reports. The other part of the reason is name recognition. Gartner and Forrester are well known names and tend to outperform less known or respected analyst reports (e.g. G2 Crowd). Also, interestingly, SiriusDecision reports, while respected and well known, have not performed well in Obility client paid search campaigns.

Competitor Campaign Performance in Paid Social

With competitor campaigns crushing it in paid search, it makes sense for Obility clients to run competitor campaigns in paid social as well. Paid social competitor campaigns can target competitor followers on Facebook, Twitter, Instagram, and YouTube or competitor user groups or skillsets on LinkedIn.

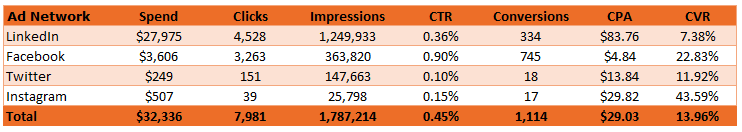

Here is data for paid social competitor campaigns run in the first five months of the year for Obility clients:

Before getting too buried in the details, one major concern is how few paid social competitor campaigns Obility clients are currently running. While clients had over 5 million impressions in search targeting competitors (over 1 million per month), Obility clients saw less than 2 million impressions in paid social across four platforms, and no Obility clients in this data group targeted competitor YouTube channels.

Even with limited data, we can make the assumption paid social competitor campaigns are effective. CPC for paid social campaigns is 70% less expensive and over 90% less on Facebook, Instagram, and Twitter. While paid social has a lower CVR, the overall CPA is pretty even between paid search and paid social.

Based on paid social competitor campaign performance, B2B marketers should be considering diverting budgets from their less successful campaigns over to paid social.

Cash in on Your Competitors

Your competitors have put in hard work building brand awareness and encouraging prospects to follow them on social media. Smart advertisers are going to take advantage of their competitors’ efforts. The smartest advertisers will also continue to test what offers perform best in targeting competitors.